Food Safety and Quality Outlook and Trends in 2023

In 2023, the food and beverage sector will explore new avenues for products, sourcing, and technology to remain better equipped to deal with the unexpected.

Several trends will shape 2023, including the economic crisis, the Ukrainian war, the rise in energy costs, inflation, labor shortages, the cost of living, consumer behavior, and health concerns.

Over the last decade, consumer preferences and awareness of the environmental impact of their food choices have significantly influenced the industry, catalyzing businesses to increase their sustainability efforts and innovate rapidly.

Food and beverage organizations will increasingly emphasize cloud-based solutions in 2023 to meet consumer demand while managing supply chain instability and climate change concerns. Regulations and developments enhancing consumer safety and quality will continue to be a priority.

Food and beverage organizations will increasingly emphasize cloud-based solutions in 2023 to meet consumer demand while managing supply chain instability and climate change concerns. Regulations and developments enhancing consumer safety and quality will continue to be a priority.

Anticipated trends and predictions that food and beverage organizations should consider in 2023 include:

The Global Economy

After three challenging years, the food and beverage market does not look like it will get any easier in 2023, causing producers, manufacturers, and distributors to worry. Concerns regarding rising inflation, energy costs, and international conflicts have replaced pandemic fears.

In the short term, the Russia-Ukraine war disrupted the recovery of the global economy from the COVID-19 virus pandemic. Economic sanctions have affected multiple countries in the wake of the battle between these two countries. Commodity prices have spiked, and supply chain disruptions are causing inflation across markets worldwide.

The euro area in the second half of 2022 saw significant declines in activity as a result of deterioration in supply chains, increased financial stress, and decreases in consumer and business confidence. However, the most damaging effects of the invasion are surging energy prices amid significant reductions in the Russian energy supply.

The euro area in the second half of 2022 saw significant declines in activity as a result of deterioration in supply chains, increased financial stress, and decreases in consumer and business confidence. However, the most damaging effects of the invasion are surging energy prices amid significant reductions in the Russian energy supply.

Companies in the food and beverage industry seek efficiencies within their organization to offset the effect of uncontrollable factors on performance and profitability. In 2023, F&B organizations intend to focus on operational improvements and waste reduction through investments in technologies that will be pivotal in assisting in delivering these operational efficiencies.

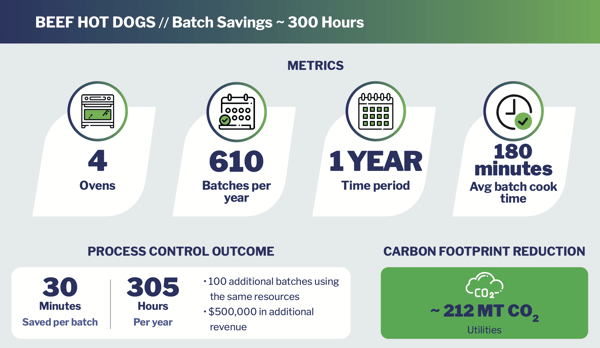

Novolyze’s Process Control Solution, for example, is a science-based digitalization solution that introduces the optimization of processes through dynamic monitoring. This leads to an increase in throughput and a reduction of carbon footprint while maintaining the highest product safety and quality standards.

Disruptions to the Supply Chain

Supply chain management will be a primary concern for food and beverage companies in 2023. The food and beverage industry is no stranger to managing disruptions in their supply chains. The effects of the COVID-19 pandemic made the necessity for changes in processes and operations all the more critical.

Recently, many companies realized how poorly prepared they were for the unexpected fragility of the global and local supply chains. Shortages and irregular supplies place a great deal of stress on manufacturers and retailers, who now need to manage their inventory better and diversify their supply sources. Market disruptions over the past few years have tested the end-to-end capabilities of food companies, emphasizing the importance of an adequate supply chain management system in 2023 to enhance their overall business resilience.

Recently, many companies realized how poorly prepared they were for the unexpected fragility of the global and local supply chains. Shortages and irregular supplies place a great deal of stress on manufacturers and retailers, who now need to manage their inventory better and diversify their supply sources. Market disruptions over the past few years have tested the end-to-end capabilities of food companies, emphasizing the importance of an adequate supply chain management system in 2023 to enhance their overall business resilience.

Manufacturing of food has become increasingly complex over the past few decades. Shifting consumer demands makes it compelling for food manufacturers to diversify their product offerings. Consequently, this has increased the number of ingredients used to manufacture food and beverage products. In response to these changes, supply chains have grown more protracted and fragmented, with products passing through more facilities and traveling in many directions before being delivered to consumers.

Food and beverage organizations need to ensure that their traceability systems are robust, including knowing where their ingredients originate and where they go once they leave their location, to improve consumer confidence in products.

Upcoming amendments to the finalized FDA Food Safety Modernization Act (FSMA) Rule 204 require faster identification and removal of potentially contaminated food from the market. Traceability will be a priority for food and beverage organizations in 2023, primarily for North American manufacturers and distributors.

Sustainability and Consumer Behavior

In 2023, the food and beverage sector will focus on becoming more sustainable. Companies are implementing more eco-friendly practices in their food safety processes to reduce their carbon footprint. Several food companies report that customer demand for green processes and products is a major driving force behind their focus on sustainability. Consumers' awareness of the environmental impact of their food choices is growing, which motivates them to seek out sustainably made food products.

The goal of sustainability is also closely aligned with that of efficiency, with F&B organizations hoping to reduce energy and waste consumption by promoting sustainability initiatives. These companies believe sustainability will give them a competitive advantage in the marketplace.

The goal of sustainability is also closely aligned with that of efficiency, with F&B organizations hoping to reduce energy and waste consumption by promoting sustainability initiatives. These companies believe sustainability will give them a competitive advantage in the marketplace.

Several regions will also experience significant changes in sustainability legislation in 2023. For example, the Germany Supply Chain Due Diligence Act implementation to enhance the protection of environmental and human rights in the food supply chain. In addition, companies are undertaking efforts to achieve the UN's Sustainable Development Goals for 2030.

Data analytics will play a critical role in the success of food sustainability strategies in 2023. Defining and tracking sustainability goals requires benchmarking the current capabilities within the organization. Using cloud-based solutions and operational technologies with business intelligence (BI) tools can expedite and demonstrate to customers the effectiveness of their sustainability efforts.

For example, a Novolyze customer with a 4-oven beef hot dog processing facility was able to realize a yearly carbon footprint reduction of ~212 MT CO2 using Novolyze’s Process Control Solution.

Technology Leveraging

The digital age continues to flourish as technology adoption increases. By 2050, global spending on innovative technologies and connected systems is expected to triple.

In 2023, artificial intelligence (AI) will play an increasingly important role in food production, enabling the production of more efficient, predictable, and safe products. Artificial intelligence and machine learning are valuable for analyzing large amounts of data quickly and accurately, making them helpful tools for detecting food safety issues. Analyzing patterns in outbreaks of foodborne illness or identifying potential risks in the supply chain can be achieved using these technologies.

Blockchain technology is a digital ledger that uses cryptography to store, manage and generate data. Blockchain enables food tracking from farm to fork by recording information throughout the supply chain, including where and how the food was grown, processed, and transported and the temperature during transport.

Blockchain technology is a digital ledger that uses cryptography to store, manage and generate data. Blockchain enables food tracking from farm to fork by recording information throughout the supply chain, including where and how the food was grown, processed, and transported and the temperature during transport.

By providing transparency about the origin of ingredients in food products, blockchain can help prevent foodborne illness. The visibility into the supply chain enables producers to identify adulterated or contaminated products before they reach consumers. For example, if an outbreak occurs, governments can quickly trace its origins; and retailers can swiftly recall affected items without causing unnecessary anxiety or fear among consumers.

The rise in Blockchain technology adoption enables the transparent and secure tracking of food products, ensuring their safety and quality. In 2023, companies in the food and beverage industry will continue to adopt this technology to improve traceability and increase consumer confidence. The food and beverage sector can benefit from these technologies as their capabilities continue to grow in 2023 and beyond.

Labor – Help Needed

A labor shortage is among the biggest concerns of leaders of food and beverage companies in 2023. As manufacturing and processing facilities continue to automate, the nature and requirements for labor are constantly changing. As a result, specialized workers are in greater demand. To address this scarcity, on-the-job training, utilizing third-party services, and hiring more skilled workers with the necessary technical capabilities have become increasingly popular approaches.

In 2023, the food and beverage industry will expand its reliance on digital technology implementation. Moving from local servers to cloud computing and providing remote machine control access are examples of digital transformation strategies to alleviate labor shortages experienced in the food processing industry.

Regulatory Initiatives

Government agencies are increasingly regulating the food and beverage industry to protect consumers and ensure product safety. As part of this effort, stringent requirements have been placed on food safety tests and inspections, and stricter penalties for companies that violate food safety regulations. Recent events, notably the Coronavirus pandemic, have raised awareness of hygiene compliance and the necessity of implementing robust and proactive HACCP, GFSI/SQF, BRC, and sanitation protocols.

Several changes are expected in the world of food safety and hygiene in 2023, including the following:

- The Addition of Sesame to Allergen List

- In the United States, sesame is the ninth major food allergen listed by the Food and Drug Administration (FDA). In 2004, the FDA identified eight food allergens causing the most severe allergic reactions in humans. These include milk, eggs, fish, crustaceans and shellfish, tree nuts, peanuts, wheat, and soybeans. By January 1, 2023, companies must comply with additional sesame labeling and allergen management requirements.

- New BRCGS Audit Certification Standard

- On August 1, 2022, the British Retail Consortium Global Standard (BRCGS) published Issue 9 Revision. Starting in February 2023, audit certifications to the updated standard will begin. A vital component of the changes is the emphasis placed on developing an adequate food safety and quality culture and on developing hygienic facilities and equipment.

- FSMA Final Rules – Key Dates

- Small Farms - Non-Sprout Produce (agricultural water requirements)

- January 26, 2023, compliance deadline

- Small Farms - Non-Sprout Produce (agricultural water requirements)

Conclusion

As consumers continue to demand transparency regarding the source of their food products, the food and beverage industry must prepare for increased scrutiny regarding how their suppliers or manufacturers source ingredients to maintain compliance with regulations such as the Food Safety Modernization Act (FSMA) and Global Food Safety Initiative (GFSI).

Companies must be transparent about their sustainability practices by communicating with consumers the origins of their products and what is utilized during manufacturing processes, in addition to being more responsible with material sourcing and reducing waste in production processes.

Data analytics can assist food companies in making better decisions and improving efficiency across their operations and supply chains by providing additional information about consumer preferences, outbreaks of foodborne illness, or recalls at various points along the value chain.

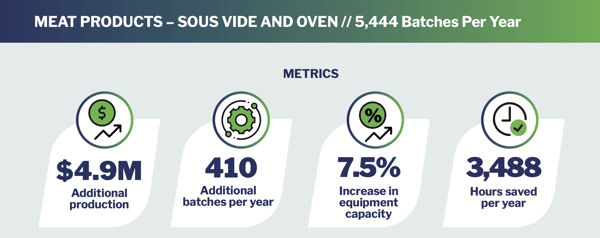

For example, Novolyze’s Process Control Solution was able to optimize the efficiency of a customer’s sous vide and oven facility, leading to $4.9M in additional annual production.